The three things we learned at the Auto Trader New Car Awards 2024

Last week we unveiled the winners of the Auto Trader New Car Awards 2024. There were 23 awards, including the New Car of the Year, but unlike other awards, these awards aren’t determined by the opinions of journalists, rather they are chosen by those people who matter most to our industry, car owners.

Over 200,000 car owners took part in the survey, sharing exactly what their cars are like to live with in order to determine the winners. But, as well as discovering the very best new cars as chosen by owners, what else did we find out in our survey.

Read on to find out.

New car buyers don’t just look at new cars

It sounds like a contradiction, but, as we revealed at this year’s awards, new car buyers don’t just look at new cars, they also explore used cars.

In fact, almost all potential new car buyers on our platform, also looked at a used car during their research process. This perhaps isn't too surprising when we consider the relative size of the used car market, but it does highlight that the new car buying journey is far from a linear one.

Interestingly, the reverse is also true; a large proportion of used car buyers also look and consider new cars on our platform.

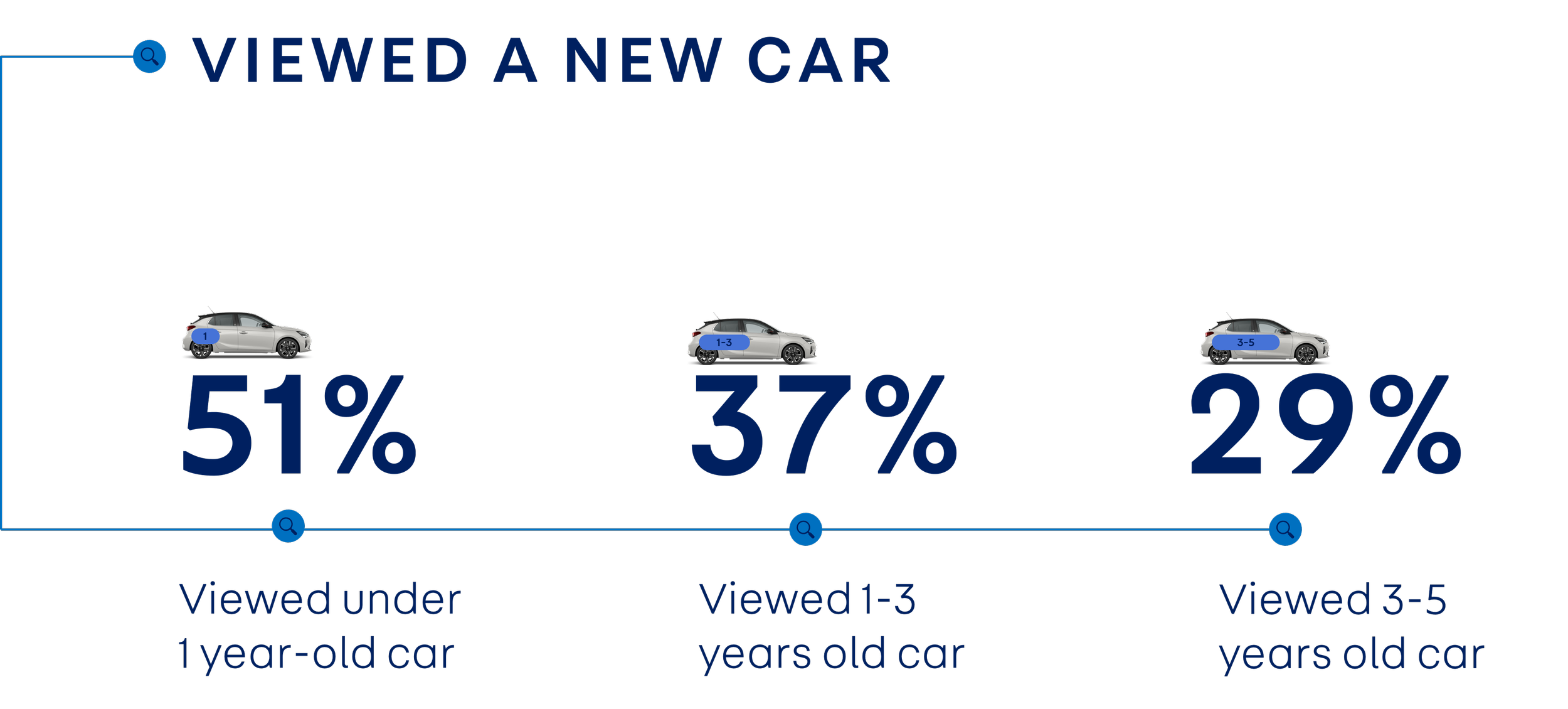

Our research shows that around half of everyone looking at nearly new cars (those aged below 1 year old) also looked at a new car, whilst more than a third of people considering a 1-3-year-old used car also looked at least one new car in their journey.

So, there are more people looking at new cars right now than you might think – the opportunity is huge.

New car buyer behaviour is changing

Our survey has shown that new car buyers are doing more of their car buying journey online than ever before. Nearly a quarter (24%) of new car buyers say they did their research online only, whilst seven in ten (68%) said they did their research with a mix of both online and in-person at a dealership.

In other surveys, we get a view on where they do their research, with three in four using online marketplaces, half dealership websites and 41% manufacturer websites.

Contrary to what we’re sometimes told, YouTube and social media aren’t having a major impact on car buying; only 22% of car buyers turned to YouTube and just 18% to social media to research their next new car. Whilst still significant this is still some way below traditional car review sites.

Most car buyers do online research, and most car buyers do also visit a dealership. Buyers want an omnichannel experience and not a fully online one.

But when it comes to online, we are seeing that most new car activity takes place outside of office hours. Almost two-thirds (62%) of all new car activity takes place outside 9-5, with a fifth of activity happening between 10pm and 8am. That means that a fifth of new car research taking place while the media budget’s tailed off, the call centres are closed and salespeople are tucked up in bed dreaming about an inbox full of fresh leads in the morning. It’s worth then considering how you can optimise media spending to capitalise on this growing trend.

EV owners love their cars but are less loyal than traditional car owners

This year saw electric cars make up 24 of all cars shortlisted (of 42 model-level awards), taking over half of all of the nominations for the first time in the Awards’ history. Just three years ago that number was 16, showing us just how fast things are changing.

And changing they are, because when we look at EV buyers' answers in our survey and the brands' performance on our new car platform, we’re seeing some key differences emerging.

Firstly, electric car buyers are younger, with 55% under 55 vs. 44% for new internal combustion engine cars(ICE), but the 35-54 group is the sweet spot, taking 45% of new EV buyers. ICE then has very much become the choice of older buyers.

EV owners also pay more for to their car with 43% paying over £40k vs 13% new ICE, making them 3x more likely to pay £40k or more. This isn’t surprising when we see a 35% RRP difference between electric and petrol but it does show that EVs do continue to appeal or are only accessible to a wealthier audience.

Interestingly, EV owners drive more, with 40% of owners driving 10,000 miles or more per year vs. 25% new ICE. Range anxiety then is not a concern for owners and the running cost savings from an EV are clearly appealing to those drivers travelling long distances. In fact, the all-electric Nissan Ariya was this year’s best car for long distances.

How EV and ICE owners rate their cars on driving and cost factors.

EV owners also like their cars more than ICE owners, rating them as faster, more fun, more comfortable than ICE counterparts. Owners rate the running costs but they do feel a slight pang when asked about whether their car is good value for the price, where EV trails ICE.

Finally, EV owners differ in what they are looking for from their car. We asked people to select the biggest factor when choosing their car, and after working out the running cost numbers the environmental impact was second. Technology was also a strong factor for EV considerers with 11% of survey respondents ranking it as the most important factor when choosing a new EV.

However, if manufacturers major on the power of their brand then they could be at a disadvantage. EV buyers were 4x less likely to choose that as the most important factor compared to ICE drivers. In fact, EV buyers are half as likely to have bought from the same brand as ICE buyers (19% versus 41%). There is everything to play for then when looking to attract new buyers to a new EV.

Discover the winners of the 23 awards and download your awards assets here.