The Chinese automotive industry: Challenger or partner?

Recently several Auto Trader colleagues, including our Commercial Director, Ian Plummer, visited China to see first hand the scale of its automotive market and to better understand what potential impact its growing array of brands and electric models may have on the UK. After spending several weeks visiting key manufacturers, meeting with senior government officials, and attending the Beijing motor show, they returned with fascinating insight into the current and future Chinese market. Here, we wanted to touch on some of their findings, including what opportunities China’s ambitions outside of its home market represent, and how it may shape the established order in the years to come.

A story of growth

China’s automotive industry has seen astonishing growth in recent years. At the start of the millennium, the country produced just two million vehicles domestically with no export market. But since then, the industry has accelerated dramatically with vehicle production increasing over 37% since 2013. Last year saw the production of some 30 million cars, more than the next three largest car-producing countries combined.

The growth of the domestic car buying market saw international brands flock to Chinese shores. Since 2015 there has been a 26% increase in the number of active brands in the Chinese automotive market, and today there are around 150 brands in total, of which 97 are domestic, and 43 are joint venture brands. Of these brands, 100 are selling electric vehicles (EVs).

The Chinese EV market is now well into mass adoption with some cities reaching over 50% mix of new EV sales. Thanks to a compelling mix of incentives, high product quality, and good charging infrastructure, buying an EV in China is a ‘no-brainer’ for many consumers. China has effectively leapfrogged the early majority chasm that most other markets, including the UK, are struggling to address, helping to make EVs mainstream.

However, as per the above, there are also a significant number of brands selling electric vehicles in China, leading to heightened competition and oversupply. BYD now takes a dominant EV market share position in China with the 100 other EV-producing brands fighting for the remaining 28% market share and putting pressure on Western brands importing to the market.

Such is the growth of China’s domestic EV production that they are now experiencing production overcapacity relative to domestic sales, which means it has significant export capacity.

Supply chain means China is well ahead of the competition

Battery costs have fallen dramatically in the last decade.

China now produces 77% of all EV batteries, with five of the ten biggest battery producers being Chinese, with the top two - CATL and BYD - taking a 50% market share.

This dominance of the battery supply chain means that costs can be reduced and this is one of the reasons why, on average, an EV in China is now 14% cheaper than an ICE equivalent. It’s in stark contrast to the UK where EVs command a 35% premium over ICE equivalents. Chinese brands are actively seeking to reduce battery costs even further, with the cost of a battery now 30x less than it was ten years ago and set to fall further. This will reduce the costs of new EVs globally but with such a dominance over the battery supply chain it will have more of an impact on Chinese models.

The reduction in battery and labour costs means that brands can now offer products at low prices, without compromising quality. During their visit, our colleagues noted that many Chinese models have levels of interior and exterior quality that can rival the offerings of more established (and premium) players. They were particularly impressed with the likes of BYD’s Seagull, Leapmotor’s C10 and NETA’s Aya.

But it's not all about the price tag. The interior / exterior fit and finish combined with the market /world leading technology of Chinese built electric vehicles is hugely impressive at both ends of the market, which will leave some western rivals with a significant challenge to compete on those fronts.

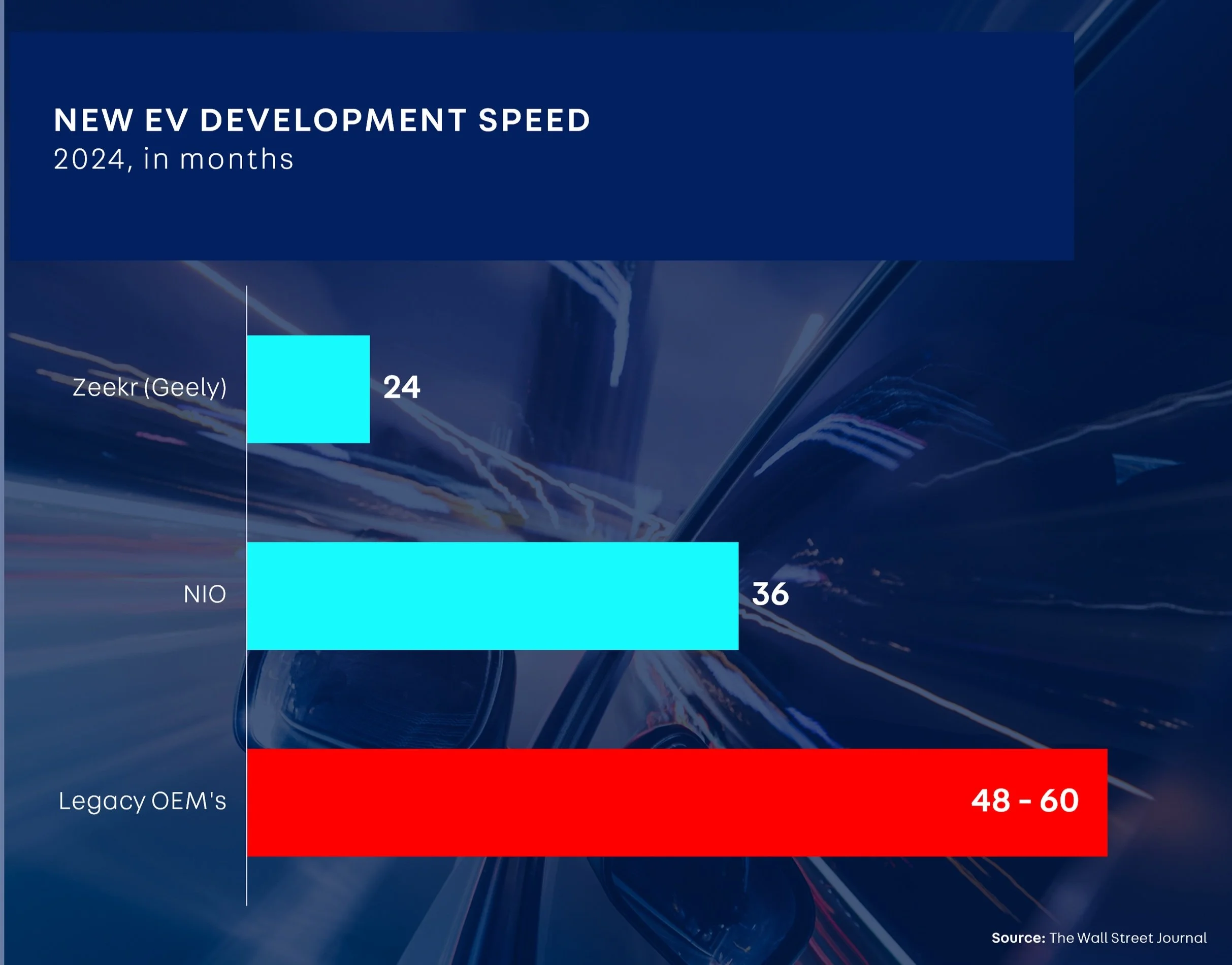

Chinese manufacturers are able to develop and release new EVs faster than legacy OEMS.

Things don’t stay still for long

A phrase that our team regularly encountered on their trip was “China speed”. As already highlighted in this blog the industry has grown far quicker than many may have predicted. But it's not just the speed at which the industry has grown, but also the speed at which new products are developed and launched.

Chinese manufacturers can deliver new technology and models to the market significantly faster than their more established western counterparts. In fact, many new manufacturers have been able to leapfrog ICE production altogether and go straight to electric, whilst the more established legacy brands have had to undergo a lengthy (and expensive) transition from ICE to EV.

What’s more, product lifecycles for Chinese-made EVs can be half that of legacy manufacturers, enabling Chinese brands to get new products with the latest technology to market far faster. And it's not just the speed at which they can launch new models, but also the volume of new models they can get to market each year which again eclipses legacy manufacturers.

Challenger or partner?

There are both challenges and opportunities presented by the emergence of Chinese brands.

Chinese expertise in EVs is now being utilized by more established brands to accelerate their own EV development. New joint ventures between Volkswagen and Xpeng and between Stellantis and Leapmotor are just some such partnerships that are reshaping the global automotive space.

Although the impact thus far has been fairly limited, the arrival of new entrants to our shores does mark the beginning of what will certainly be a re-shaping of the UK retail market as Chinese brands battle it out for market share.

We can already see this playing out on our platform, where interest in BYD and GWM is on the rise. BYD in particular is making traction, boosted by its very high profile of the Euros which is helping to drive awareness among UK consumers. During the first weekend of the tournament, there were 26,000 views of BYD models on our site, which was a whopping 69% increase on the previous weekend.

The surge of new Chinese entrants will see winners and losers. They present buyers with more choice in affordable EVs. But they do put pressure on more established OEMs with their rapid advancements and competitive prices. They also present retailers an opportunity to bet on new brands. Some will fail of course but so to may legacy brands.

One thing is for certain though: we are entering a pivotal time in our industry, one that will see significant change, but also significant opportunity.

If you would like to hear more about the impact of new Chinese entrants and what our colleagues discovered on their trip, then please do check out our recent dedicated webinar here.