The key takeaways from The Road Ahead for Automotive Retail conference

We recently hosted our inaugural The Road Ahead for Automotive Retail conference where we heard insights, alongside our own, from OC&C Strategy Consultants, and MHA Financial Consultants into what the future holds for retail with a particular focus on the impact of Connectivity, Autonomy, Subscriptions, Electrification, Distribution and Digitisation (CASEDD).

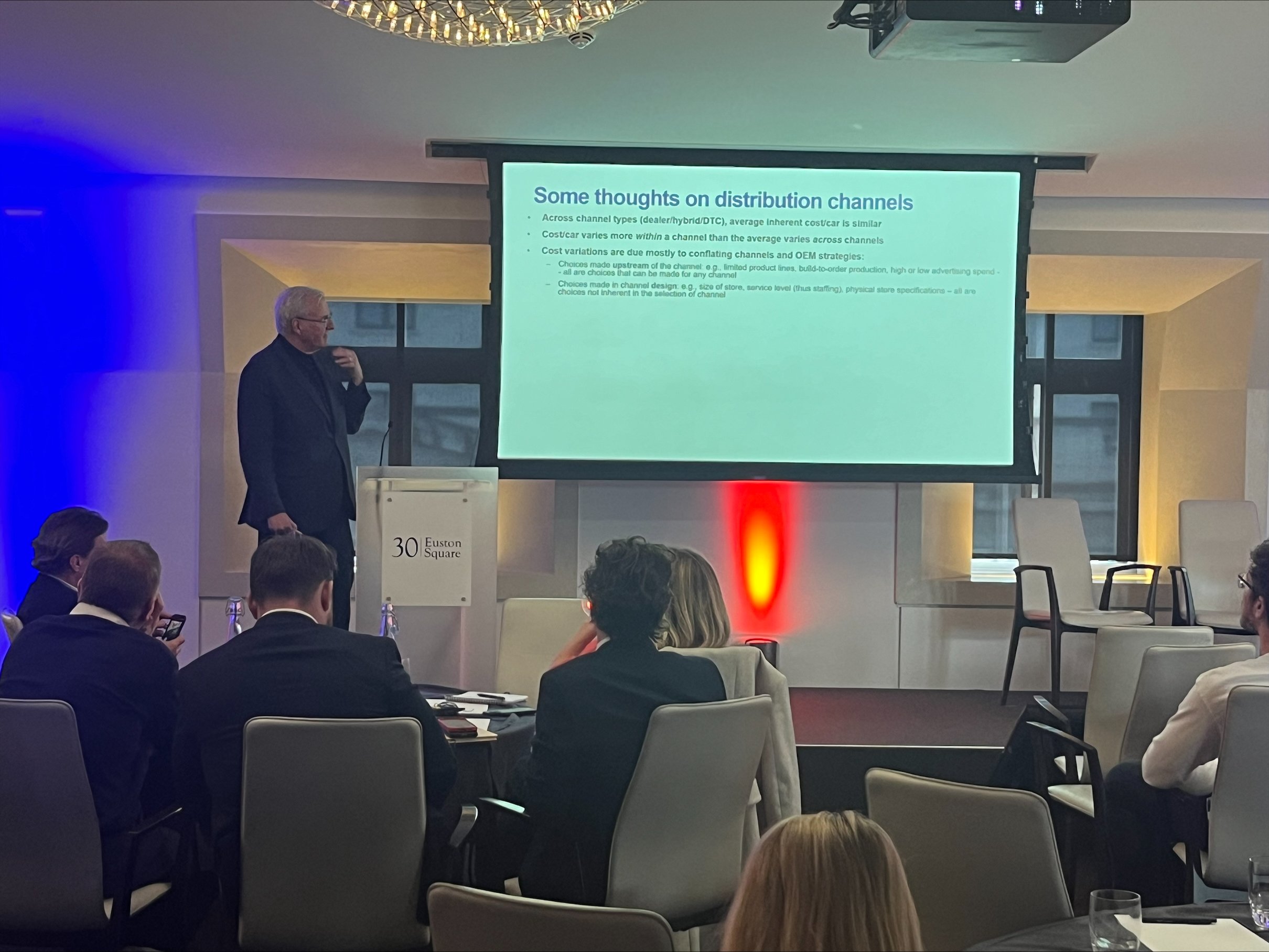

The event also featured a powerhouse panel, with business leaders from Stellantis, Inchcape and Sinclair Group all sharing their views on the future of retail, and a keynote presentation from world-renowned industry researcher Glenn Mercer who shared what lessons we can take from the US market.

The slides from both the CASEDD segment and Glenn’s session are available to download at the end of this blog and below you will find a summary of the key points raised at this year’s event.

The electric market is growing up

We now see a complete market, with growing choice in used, a much clearer picture of the price at which electric vehicles will sell and a better idea of the rapid changes electrification will mean not just for sales, but for after-sales, and even the power your businesses consume.

The path to electric vehicles is set, they will be the market and the best-performing retailers are already making electric work for them.

The most successful retailers will be those who:

Are experts in electric vehicles – are thoughtful about the brands they represent, and understand how to source, stock and sell new models and features they haven’t worked with before

Actively address the impact on aftersales. For some, there’s an opportunity in older cars, others with fleet customers or commercial vehicles or repair and body shop business

The most successful retailers will deliver customer experience excellence, in both sales and aftersales, to help conversion, and also retention

More than ever, consumers tell us they want support, electric vehicle buyers are much more likely to ask the retailer for ideas and advice than ICE customers. The transition to electric vehicles means the role of the retailer in the buying journey is more important than ever.

So when it comes to electric vehicles, the path is set, get ahead of the change, and support buyers to navigate this journey.

Retail will always need retailers

As manufacturers look for ways to mitigate the investment in electrification, distribution models have been a key area of focus. But few are in a position to make this work.

At the event, MariaGrazia Davino, Managing Director, Stellantis UK talked about the importance of partnership and it’s clear that manufacturers are finding their way – a couple have committed and are learning lessons, others have delayed and market conditions are changing their strategies.

But the imperative to change the economics of distribution is still there for manufacturers, so retailers need to think about agency being delayed, but not abandoned.

Not every manufacturer is taking the same approach to agency though, we expect new agency ‘lite’ and new ‘franchise plus’ models to emerge, where manufacturers look to get some of the assumed benefits of the model, without the significant transfer of risk and capital.

Retailers should be thinking ahead, they should have a Plan B which may include:

A renewed focus on the business functions outside of new cars to drive efficiency and greater profitability

Identifying where you have control and can maximise your strengths, whether that be in processes, service, technology or data, and

For those Manufacturers that move ahead with Agency ‘lite’, there will be reduced costs in stocking, marketing and other areas – think about redeploying this to drive growth in other parts of your businesses

It is not in the interests of the manufacturers to try and replace retailers, and nor are they equipped to do so – too much complexity, not enough expertise, too much cost. They need retailers.

Omnichannel is the future

The battle to acquire customers is online, where many retailers are already ahead with years of experience in identifying buyers, merchandising, using data to drive performance, pricing to the market and changing in real-time – in adapting the success metrics you use away from simple volume measures like website clicks or leads to more sophisticated things like performance ratings and speed of sale.

Retailers have the added advantage of delivering the physical touchpoint nine in ten car buyers are looking for.

The car buying journey has never needed retailers more than it does today and the event highlighted that omnichannel retailing has killed online.

A few years ago, everyone was talking about online retailing being the future, but we’ve seen the decline of the online first retailers, they serve a small and shrinking segment of the market.

Omnichannel is the future, supporting customers with a connected, blended retailing experience, combining the best digital experience with a brilliant forecourt experience.

Buyers are arriving more qualified, and closer to the point of purchase when they arrive on retailers' forecourts.

But importantly almost all buyers still want a forecourt experience. For most people, it is the second biggest purchase they make, and they value the support provided by retailers and value the opportunity to experience the product before they commit. Only retailers can provide this support.

And digitisation more broadly is where the growth opportunity lies for businesses.

Doing nothing simply isn’t an option, with MHA highlighting the massive financial impact of inaction when it comes to digitisation.

These changes are coming, at various times, but in the case of electrification and distribution, they’re not too far away. And they’re a catalyst for change, an opportunity, to digitise not just the consumer experience but also our businesses. To embed digital tools into back-end functions, utilise the data and technology available, and drive down costs.

The building blocks of the best retailers

If the role of retailers has never been more important – then how are the best retailers responding?

There are a few characteristics that we believe unite the best retailers.

They combine great instincts with the latest market insights and are led by both – the market is complicated and changing fast, and they follow it.

They harness and deploy data and technology to drive down cost at the same time as delivering it ‘all’ to consumers – brilliant digital journeys combined with brilliant physical forecourt experiences, delivering excellent customer service with a personal touch, that only retailers can do.

They enable consumers to go on this journey, they follow the buyers, rather wait for them to drive the change.

The road ahead for automotive retail is going to look different, but with it will come opportunities to redefine and strengthen the role of the retailer. The role of the retailer is becoming more, rather than less important.

As well as being a decade of change, it’s also a chance to build the businesses we want for the next decade.

That requires planning and action. The insights and ideas from today are a good place to start on those plans. For all of us to take the chances that are there from this change.

The future is Retailer.